Calculate depreciation deduction

Section 179 Deduction Calculator. C is the original purchase price or basis of an asset.

Section 179 And Bonus Depreciation In 2013 Blackburn Childers Steagall Cpas

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

. In this case you must calculate the depreciation deduction for the later year. The syntax is SYD cost salvage life per with per defined as. Tax depreciation expense can be calculated by using approved methods only.

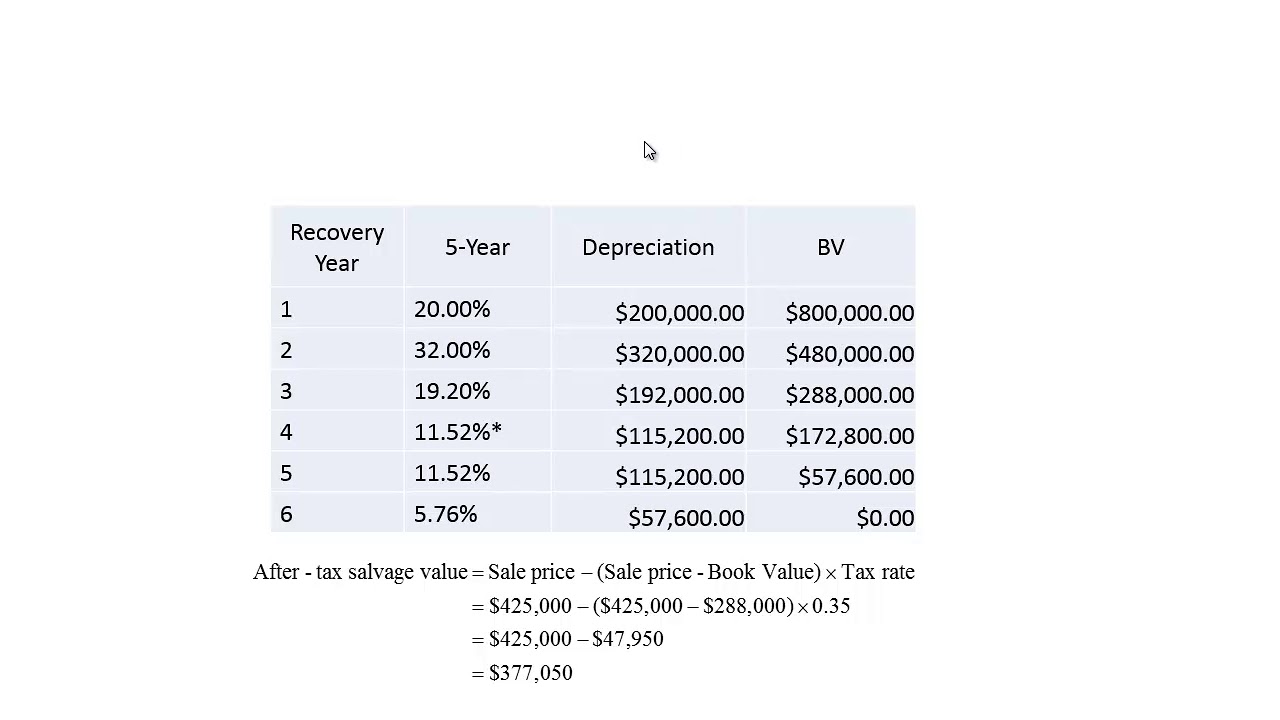

Total Depreciation - The total amount of depreciation based upon. Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. Using the MACRS 5-year column on the Depreciation Table heres the calculation which multiplies the basis dollar amount by the appropriate depreciation percentage.

Essentially CCA is a tax deduction associated with the depreciation of assets under Canadian tax laws. There are several options to calculate depreciation. Example Calculation Using the Section 179 Calculator.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. This means the van depreciates at a rate of. The CRA divides all the assets eligible for CCA claim into different.

The most straightforward one typically used for home improvements is the straight-line method. Percentage of square feet. To do it you deduct.

Where Di is the depreciation in year i. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. 35000 - 10000 5 5000.

You can calculate this percentage in one of two ways. The MACRS Depreciation Calculator uses the following basic formula. Likewise the business will calculate the depreciation charge for all qualified tangible assets.

Measure the size of your home office and measure the overall size of your home. You can use the simplified method in one year and the actual-expenses method in a later year. The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per.

D i C R i. By using the formula for the straight-line method the annual depreciation is calculated as.

Bellamy Strickland Commercial Truck Section 179 Deduction

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Macrs Youtube

Depreciation Formula Calculate Depreciation Expense

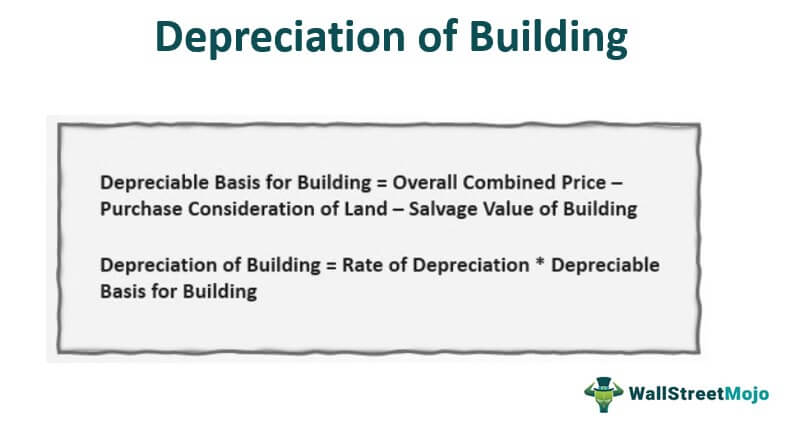

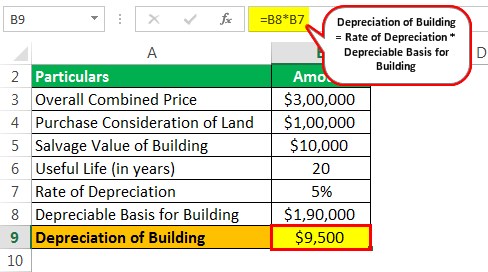

Depreciation Of Building Definition Examples How To Calculate

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Macrs Depreciation Calculator With Formula Nerd Counter

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How To Use Rental Property Depreciation To Your Advantage

Tax Shield Formula Step By Step Calculation With Examples

Calculate Annual Depreciation Deduction With A Short Tax Year Depreciation Guru

Depreciation Of Building Definition Examples How To Calculate

How To Calculate Depreciation Expense For Business

Guide To The Macrs Depreciation Method Chamber Of Commerce

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Free Macrs Depreciation Calculator For Excel